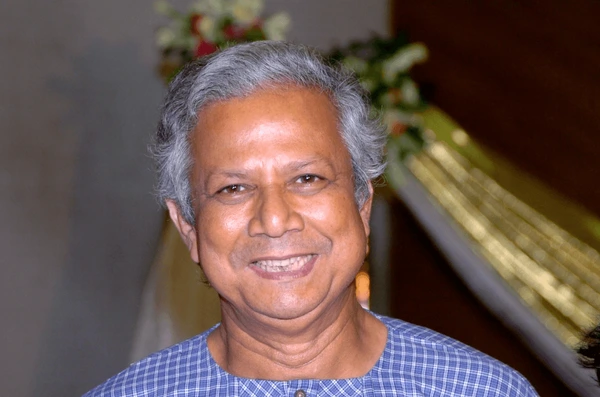

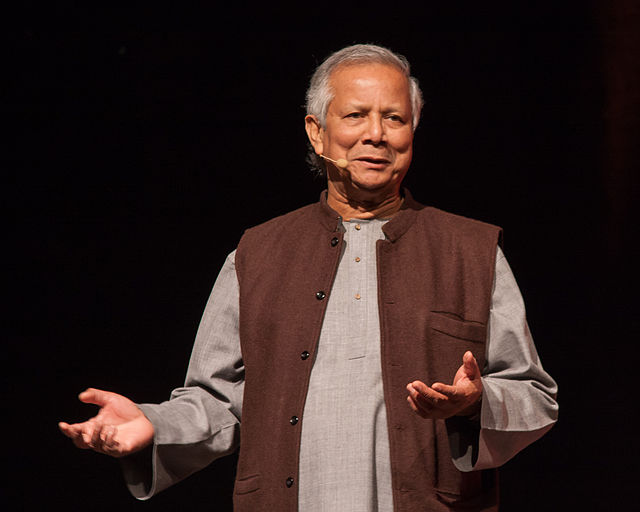

Dr. Muhammad Yunus is a Bangladeshi economist, Nobel Peace Prize laureate, and the visionary founder of Grameen Bank. Renowned as the “Father of Microcredit,” he revolutionized global poverty alleviation by empowering millions through small, collateral-free loans. Beyond banking, he introduced the concept of social business and champions a world of Three Zeros—zero poverty, zero unemployment, and zero net carbon emissions. Globally celebrated for his humanitarian leadership, Dr. Yunus remains a symbol of ethical innovation and inclusive development. His life’s mission: to create a world where poverty becomes a relic of the past, and every person can thrive with dignity.

Dr. Muhammad Yunus at a Glance

Born: June 28, 1940, Chittagong, Bangladesh

Education: Ph.D. in Economics, Vanderbilt University (USA)

Founder of: Grameen Bank (1983)

Nobel Peace Prize: 2006 (with Grameen Bank)

Innovations: Microcredit, Social Business, Three Zeros Vision

Impact: Over 100 countries have adopted his microfinance model

Global Honors: 150+ international awards, including:

Presidential Medal of Freedom (USA)

Congressional Gold Medal (USA)

World Food Prize

Famous Quote: “We can put poverty in the museums.”

Vision: A world with Zero Poverty, Zero Unemployment, and Zero Net Carbon Emission

A Humble Beginning

Dr. Muhammad Yunus was born on June 28, 1940, in Chittagong, a bustling port city in what was then British India (now Bangladesh). Raised in a modest yet nurturing family, Yunus exhibited early signs of leadership and compassion. His father was a successful jeweler, while his mother’s charitable nature deeply influenced his worldview. Even as a child, Yunus was aware of the widespread poverty around him—an awareness that would later shape his life’s mission.

Academic Excellence and Global Exposure

Yunus completed his secondary education at Chittagong Collegiate School and pursued economics at the University of Dhaka. He was awarded a Fulbright Scholarship to study in the United States, where he earned a Ph.D. in Economics from Vanderbilt University in 1969. During his time abroad, he taught economics and absorbed modern economic theories. However, his heart remained connected to the people of Bangladesh.

A Return to Roots and the Birth of a Revolutionary Idea

Following the liberation of Bangladesh in 1971, Yunus returned and joined Chittagong University as Head of the Economics Department. In 1974, during a famine, a visit to the village of Jobra led him to lend $27 to a group of poor women struggling under exploitative lenders. This small act planted the seed for a revolutionary concept: microcredit. The impact was immediate and profound, and Yunus realized the potential of small loans to change lives.

Founding Grameen Bank

In 1983, Dr. Yunus established Grameen Bank—a financial institution tailored to the needs of the poor, especially women. The bank provided collateral-free microloans to promote self-employment and entrepreneurship in rural areas. Grameen Bank became a global model for poverty alleviation, showcasing the power of trust and social responsibility in banking.